Saudi Arabia Cloud Computing Market Demand Outlook, COVID-19 Impact, Trend Analysis by Service Model (SaaS, IaaS, PaaS), by Deployment Mode (Public cloud, Private cloud, Hybrid Cloud), by Infrastructure, by Pricing Model, by Enterprise, By End Use and Industry Estimates 2020-2030

- Published: May, 2021

- Report ID: QAR-ICT02021

- Format: Electronic (PDF)

- Report Summary

- Table Of Contents

- Request Sample

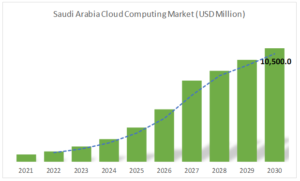

The Saudi Arabia Cloud Computing Market is projected to grow at a CAGR of 35.5% over the next decade. The key factors contributing to the growth of the Saudi Arab cloud computing industry are the various government initiatives to promote digitalization in the country. In 2016, the government launched the National Transformation Program with Vision 2030 in mind. The ideas in this program are aimed at creating employment and diversifying the economy.

With technology being used in almost every part of the world, the Saudi government decided to use the NTP to digitally empower all sectors of the economy, including banking, finance, government, manufacturing, and healthcare. The Saudi government is also concentrating on the e-government concept in order to cut expenses, expand facilities, save time, and improve overall effectiveness and performance in the public sector. Throughout the Kingdom, ‘YESSER' has served as the umbrella body and overall controller of all procedures, events, and other issues and actions relevant to the implementation of e-government.

The entrance of global cloud computing giants into the Saudi Arabian cloud computing sector is expected to have a positive impact. In December, Saudi Aramco and Google Cloud signed an agreement to provide services to Saudi Arabia customers. Saudi Telecom Company (STC) and eWTP Arabia, a venture capital firm, have announced a collaboration with Alibaba Cloud to provide high-performance public cloud services in Saudi Arabia.

Segment overview

On the basis of Service Model, The Saudi Arabia cloud computing market is categorized into three models: Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS). The Software-as-a-Service model dominates the Saudi Arabia cloud computing market. The growth is attributed to the benefits of low maintenance, cost-flexibility, and ease of deployment. The IaaS segment is projected to grow at significant CAGR over the forecast period. The high growth rate for IaaS service model is due to fact that regional market players are aggressively targeting the IaaS market segment in the country.

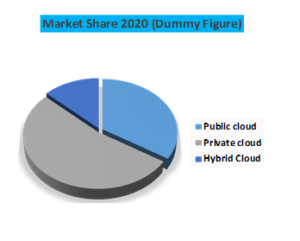

On the basis of Deployment Model, The Saudi Arabia cloud computing market is segmented into public cloud, private cloud, and hybrid cloud. The private cloud deployment model held the major share of the Saudi Arabia cloud computing market. The benefits of private cloud services, including improved data control and lower security risks, are the key drivers of segment larger adoption. The hybrid cloud model is expected to grow at the highest CAGR during the forecast period (2021-2030). The government is encouraging a lot of new technologies that generate various types of workloads that can be handled by different types of data centers, leading to an increasing need for hybrid model.

The report provides detailed market outlook, and forecast of the “Saudi Arabia Cloud Computing” market based on, service model, deployment model, Infrastructure, pricing model, enterprise and end-use.

Report Scope

| Research Attribute | Coverage |

|---|---|

| Years Considered | 2020-2027 |

| Base Year | 2020 |

| Forecast Period | 2021-2030 |

| Units Considered | USD Million |

| Segmentation By Service Model |

|

| Segmentation by Deployment Model |

|

| Segmentation by Infrastructure |

|

| Segmentation By Pricing Model |

|

| Segmentation By Enterprise |

|

| Segmentation by End-Use |

|

| Key Company Profiles | Nournet, Wafai CLOUD, CloudSigma, Google, Amazon, Oracle, Microsoft, Cisco Systems Inc, SAP SE, Alibaba Cloud, IBM, Etihad Etisalat Company, Saudi Telecom Company (STC), Sahara Net; are among others. |

CHAPTER 1. Market Scope and Methodology

1.1. Research methodology

1.2. Objectives of the report

1.3. Research scope & assumptions

1.4. List of data sources

CHAPTER 2. Executive Summary

2.1. Saudi Arabia Cloud Computing Market – Key industry insights

CHAPTER 3. Market Outlook

3.1. Market definition

3.2. Market segmentation

3.3. Technological overview

3.4. Market opportunities &trends

3.4.1. Increasing preference for multi-cloud strategy

3.5. Market dynamics

3.5.1. Market driver analysis

3.5.1.1. Growth of the IT Market in Saudi Arabia

3.5.1.2. Favorable government policies

3.5.1.3. Entry of key global market players in the region

3.5.1.4. Impact analysis

3.5.2. Market restraint analysis

3.5.2.1. Interoperability issues and security concerns

3.5.2.2. Challenges associated with the migration to cloud computing

3.5.2.3. Impact analysis

3.6. Industry analysis – Porter’s

3.6.1. Bargaining power of suppliers

3.6.2. Bargaining power of buyers

3.6.3. Threat of new entrants

3.6.4. Threat of substitutes

3.6.5. Competitive rivalry

3.7. PESTEL analysis

3.8. SWOT Analysis

CHAPTER 4. Competitive Outlook

4.1. Competitive framework

4.2. Company market share analysis

4.3. Strategic layout

CHAPTER 5. COVID-19 Implications

5.1. COVID-19 Impact analysis on Saudi Arabia Cloud Computing Market

CHAPTER 6. Saudi Arabia Cloud ComputingMarket Size and Forecast (2020 - 2030)

6.1. Saudi Arabia Cloud Computing Market, By Service Model

6.1.1. Infrastructure as a Service (IaaS)

6.1.2. Platform as a Service (PaaS)

6.1.3. Software as a Service (SaaS)

6.2. Saudi Arabia Cloud Computing Market, By Deployment Model

6.2.1. Public cloud

6.2.2. Private cloud

6.2.3. Hybrid Cloud

6.3. Saudi Arabia Cloud Computing Market, By Infrastructure

6.3.1. Data Storage & Backup

6.3.2. Resource Management

6.3.3. Application Development & Testing

6.3.4. Orchestration Services

6.3.5. Integration

6.3.6. Resource Management

6.3.7. Others

6.4. Saudi Arabia Cloud Computing Market, By Pricing Model

6.4.1. Pay-per-usepricing

6.4.2. Subscription pricing

6.4.3. Hybrid pricing

6.5. Saudi Arabia Cloud Computing Market, By Enterprises

6.5.1. Large Enterprises

6.5.2. Small and Medium Sized Enterprises

6.6. Saudi Arabia Cloud Computing Market, By End-Use

6.6.1. Banking, Financial Services and Insurance (BFSI)

6.6.2. IT & Telecom

6.6.3. Energy & Utilities

6.6.4. Life Sciences

6.6.5. Healthcare

6.6.6. Government & Public Sector

6.6.7. Retail & Consumer Goods

6.6.8. Others

CHAPTER 7. Key Players and Strategic Developments

7.1. Nournet

7.1.1. Business Overview

7.1.2. Product and Service Offering

7.1.3. Financial Overview

7.1.4. Strategic Developments

7.2. Wafai CLOUD

7.2.1. Business Overview

7.2.2. Product and Service Offering

7.2.3. Financial Overview

7.2.4. Strategic Developments

7.3. CloudSigma

7.3.1. Business Overview

7.3.2. Product and Service Offering

7.3.3. Financial Overview

7.3.4. Strategic Developments

7.4. Google

7.4.1. Business Overview

7.4.2. Product and Service Offering

7.4.3. Financial Overview

7.4.4. Strategic Developments

7.5. Oracle

7.5.1. Business Overview

7.5.2. Product and Service Offering

7.5.3. Financial Overview

7.5.4. Strategic Developments

7.6. Microsoft

7.6.1. Business Overview

7.6.2. Product and Service Offering

7.6.3. Financial Overview

7.6.4. Strategic Developments

7.7. Cisco Systems Inc.

7.7.1. Business Overview

7.7.2. Product and Service Offering

7.7.3. Financial Overview

7.7.4. Strategic Developments

7.8. SAP SE

7.8.1. Business Overview

7.8.2. Product and Service Offering

7.8.3. Financial Overview

7.8.4. Strategic Developments

7.9. Alibaba Cloud

7.9.1. Business Overview

7.9.2. Product and Service Offering

7.9.3. Financial Overview

7.9.4. Strategic Developments

7.10. IBM

7.10.1. Business Overview

7.10.2. Product and Service Offering

7.10.3. Financial Overview

7.10.4. Strategic Developments

7.11. Etihad Etisalat Company

7.11.1. Business Overview

7.11.2. Product and Service Offering

7.11.3. Financial Overview

7.11.4. Strategic Developments

7.12. Saudi Telecom Company (STC)

7.12.1. Business Overview

7.12.2. Product and Service Offering

7.12.3. Financial Overview

7.12.4. Strategic Developments

7.13. Sahara Net

7.13.1. Business Overview

7.13.2. Product and Service Offering

7.13.3. Financial Overview

7.13.4. Strategic Developments