Smart Coating Market Size, Demand Outlook, Trend Analysis by Type(Anti-corrosive, Self-cleaning, Smart Roof Coating, Self-healing, Anti-fouling, Smart anti-microbials, Electrochromic, Anti-icing, Others), By Type (Organic, Inorganic, Hybrid) by Industry (Construction, Aerospace, Automotive & Transportation, Marine, Healthcare, Defence, Electronics, Others), By Surface area, Shipments and Industry Estimates2022-2027

- Published: Aug, 2022

- Report ID: QAR-FM02037

- Format: Electronic (PDF)

- Historical Data : 2017 - 2019

- Report Summary

- Table Of Contents

- Request Sample

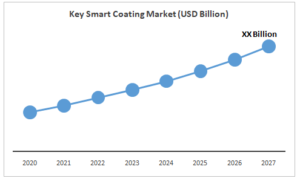

The Global Smart Coating market is projected to grow at a CAGR of 32.0% over the next six years. Given the advancement in nano technology, coatings are getting smarter day by day. Coatings provide answers to some of the Automotive industry's unmet needs, and they're backed up by a lot of research into smart additives and novel formulation processes. Enhanced chemical resistance and scratch repair are important motivations toward the development of self-healing or self-repairing topcoats in order to extend the lifetime of automobile and improve aesthetic appearance. Smart coatings have become ingrained in research into the functionality of coatings in a wide range of applications. Companies like PPG, Croda, and AkzoNobel have developed smart coatings like self-healing, self-cleaning, and anti-corrosion as a result of extensive research and scholarly publications. The smart coating has been widely accepted as a true solution to many of the issues face by automotive OEMs and its potential is well recognized for the future e-Mobility transportation.

Commercially available functional coatings include self-cleaning, anti-ice, anti-bacterial, and anti-fingerprint properties. Despite the fact that the functionality of these coatings has been successfully shown, there are still significant disadvantages that limit their widespread use and suitability for some applications. More research is needed, for example, to improve the control, maintenance, and long-term stability of particular formulations, to develop simple and repeatable application procedures, to improve the mechanical durability of coatings, and to make technologies more cost efficient.

For the next few years, the outlook for functional coatings research and applications is highly promising. In the case of already developed functional coatings, efforts are planned to address the aforementioned hurdles, which will increase the innovations' market readiness. Furthermore, an overall tendency is expected to seek for more environmental and bio-based formulations, as well as to mix qualities in order to achieve multifunctionality, helping to meet new market demands and improving social welfare.

Developments Across Industries

Eco and bio-based formulations to combine properties looking for multifunctionality

As innovation is key to business same goes with growing smart Coating Industry. developers are keen to develop coatings product that can serve multifunctional purposes. For Instance, Automotive being a continuously evolving and innovative industry always look for smart solutions. Sustainability and eco-friendly products not just add appeal to it but the need of the hour. Research are being carried out to develop coating that biomimetic and are sustainable. Automakers will be able to connect with this segment of their customer base with new coatings that utilize renewable resources while minimizing environmental impact and carbon footprint. Over the coming years this would be a key trend that is expected to shape the role of smart coating in automotive sector.

The need to reduce carbon emissions

For the oil and gas industry as a whole, zero emissions would require aggressive carbon reductions in all operations. An important source of emissions, which is often overlooked, is asset protection and maintenance operations, which often include painting and coating. Painting results in emissions of volatile organic compounds (VOCs) from colouring. Self-recovering coatings can help the oil and gas sector achieve zero carbon emissions. Self-recovering coatings are a type of intellectual coating that reacts to damage by automatically releasing the healing agent from the built-in microcapsule to the site of the damage. The self-repair function, thanks to the early interruption of damage, keeps the coating on the substrate for a longer period of time, which delays maintenance. Longer service cycles reduce carbon emissions, reduce maintenance costs and reduce life-cycle delays.

Possible wide array of application Coating Across Healthcare:

The regulations associated with coatings in hospital surfaces are far less when compared to medical implants and devices coatings. This will result in a higher market adoption rate of these coatings when compared to anti-microbial coatings in the future.

Hospitals have many potential areas of application which require active cleaning. ICUs, emergencies, hospital bathroom surfaces, medical boots, surgical gloves, tables, door knobs and walking aids are just some of the examples, which proves that there is a significant market opportunity for these coatings in the medical field.

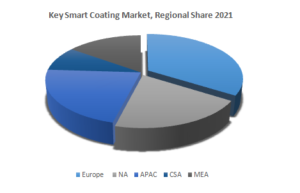

Regional Overview

On the basis of geographical segmentation, the global Key Smart Coating market has been segmented into-Europe, Asia Pacific, North America, Central and South America, and the Middle East and Africa.The market for Key Smart Coatings is dominated by Europe, Europe has witnessed numerous developments in the form of technological innovation by companies, collaborated efforts by regional universities as well as public funded EU projects that have resulted in a highly dynamic environment of smart coatings development in the energy sector. EU-funded researchers have developed smart multifunctional anti-corrosion coatings on aircraft components and car parts to reduce maintenance. costs and protect the environment. Presence of key players, such as, Akzo Nobel, BASF, Merck Group, BMW Group, Volkswagen has been a major contributor to the innovation and growth of this market. Major car manufacturing companies have announced flagship vehicles with smart coating technologies to be launched in the near future. Akzo Nobel and BASF hold the major share of paints and coatings sales in Europe and will likely be the leader in smart coating sales over the coming years. In contrast, Europe also has smaller innovative companies that have technological focus, such as, UK based Flex Enable’s OLCD tech and Finnish company Lumineq’s head-up displays.

The report provides detailed market outlook, and forecast of the “Global Key Smart Coating market” based on Function, Type, Industry, Surface area, Shipment and by region.

Report Scope

| Research Attribute | Coverage |

|---|---|

| Years Considered | 2020-2027 |

| Historical Years | 2020 |

| Base Year | 2021 |

| Forecast Period | 2022-2027 |

| Units Considered | USD Million/ Million m2 |

| Segmentation By Function |

|

| Segmentation by Industry |

|

| Segmentation by Type |

|

| Region Covered |

|

| Key Company Profiles | 3M, AnCatt, Bayer AG, Akzo Nobel,PPG Industries, Croda International, Luminary Chemical , 3E Nano , CHOOSE NanoTech, C-Bond Systems, Segula Nano technologies, The Dow Chemical Company, Research Frontier Inc., DuPontare among others. |

CHAPTER 1. Market Scope and Methodology

1.1. Research methodology

1.2. Objectives of the report

1.3. Research scope & assumptions

1.4. List of data sources

CHAPTER 2. Executive Summary

2.1. Key Smart Coating market – Key industry insights

CHAPTER 3. Market Outlook

3.1. Market definition

3.2. Market segmentation

3.3. Value chain analysis

3.3.1. Raw material trends

3.3.2. Manufacturing trends

3.4. Technological overview

3.5. Key Smart Coating Market: developed v/s developing countries

3.6. Market opportunities & trends

3.7. Market dynamics

3.7.1. Market driver analysis

3.7.1.1. Impact analysis

3.7.2. Market restraint analysis

3.7.2.1. Impact analysis

3.8. Industry analysis – Porter’s

3.8.1. Bargaining power of suppliers

3.8.2. Bargaining power of buyers

3.8.3. Threat of new entrants

3.8.4. Threat of substitutes

3.8.5. Competitive rivalry

3.9. PESTEL analysis

CHAPTER 4. Competitive Outlook

4.1. Competitive framework

4.2. Company market share analysis

4.3. Strategic layout

CHAPTER 5. Global Key Smart Coating Market Size and Forecast (2017 - 2027)

5.1. Global Key Smart Coating Market, By Function (USD Million/Million m2)

5.1.1. Anti-corrosive

5.1.2. Anti-fouling

5.1.3. Self-cleaning

5.1.4. Self-healing

5.1.5. Cool Roof Coating

5.1.6. Anti-Icing

5.1.7. Anti-microbial

5.1.8. Electrochromic coating

5.1.9. Others

5.2. Global Key Smart Coating Market, By Type (USD Million/Million m2)

5.2.1. Organic

5.2.2. Inorganic

5.2.3. Hybrid

5.3. Global Key Smart Coating Market, By Industry (USD Million/Million m2)

5.3.1. Construction

5.3.2. Aerospace

5.3.3. Textiles

5.3.4. Automotive & Transportation

5.3.5. Marine

5.3.6. Healthcare

5.3.7. Defence

5.3.8. Electronics

5.3.9. Others

5.4. Global Key Smart Coating Market, By Surface area (Million m2)

5.5. Global Key Smart Coating Market, By Shipment (Million m2)

5.6. Global Key Smart Coating Market, By Region (USD Million/Million m2)

5.6.1. North America

5.6.2. Europe

5.6.3. Asia-Pacific

5.6.4. Central & South America (CSA)

5.6.5. Middle East & Africa (MEA)

CHAPTER 6. Global Key Smart Coating Market Size and Forecast, By Region (2017 - 2027)

6.1. North America Key Smart Coating Market (USD Million/Million m2)

6.1.1. North America Key Smart Coating Market, By Function (USD Million/ Million m2)

6.1.2. North America Key Smart Coating Market, By Type (USD Million/ Million m2)

6.1.3. North America Key Smart Coating Market, By Industry (USD Million/Million m2)

6.1.4. North America Key Smart Coating Market, By Surface area (Million m2)

6.1.5. North America Key Smart Coating Market, By Shipment (Million m2)

6.1.6. The U.S. Key Smart Coating Market (USD Million/ Million m2)

6.1.6.1. The U.S. Key Smart Coating Market, By Function (USD Million/ Million m2)

6.1.6.2. The U.S. Key Smart Coating Market, By Type (USD Million/ Million m2)

6.1.6.3. The U.S. Key Smart Coating Market, By Industry (USD Million/ Million m2)

6.1.6.4. The U.S. Key Smart Coating Market, By Surface area (Million m2)

6.1.6.5. The U.S. Key Smart Coating Market, By Shipment (Million m2)

6.1.7. Canada Key Smart Coating Market (USD Million/Million m2)

6.1.7.1. Canada Key Smart Coating Market, By Function (USD Million/ Million m2)

6.1.7.2. Canada Key Smart Coating Market, By Type (USD Million/ Million m2)

6.1.7.3. Canada Key Smart Coating Market, By Industry (USD Million/ Million m2)

6.1.7.4. Canada. Key Smart Coating Market, By Surface area (Million m2)

6.1.7.5. Canada. Key Smart Coating Market, By Shipment (Million m2)

6.1.8. Mexico Key Smart Coating Market (USD Million/Million m2)

6.1.8.1. Mexico Key Smart Coating Market, By Function (USD Million/ Million m2)

6.1.8.2. Mexico Key Smart Coating Market, By Type (USD Million/ Million m2)

6.1.8.3. Mexico Key Smart Coating Market, By Industry (USD Million/ Million m2)

6.1.8.4. Mexico Key Smart Coating Market, By Surface Area (Million m2)

6.1.8.5. Mexico Key Smart Coating Market, By Shipment (Million m2)

6.2. Europe Key Smart Coating Market (USD Million/Million m2)

6.2.1. Europe Key Smart Coating Market, By Function (USD Million/ Million m2)

6.2.2. Europe Key Smart Coating Market, By Type (USD Million/ Million m2)

6.2.3. Europe Key Smart Coating Market, By Industry (USD Million/Million m2)

6.2.4. Europe Key Smart Coating Market, By Surface area (Million m2)

6.2.5. Europe Key Smart Coating Market, By Shipment (Million m2)

6.2.6. Germany Key Smart Coating Market (USD Million/Million m2)

6.2.6.1. Germany Key Smart Coating Market, By Function (USD Million/ Million m2)

6.2.6.2. Germany Key Smart Coating Market, By Type (USD Million/ Million m2)

6.2.6.3. Germany Key Smart Coating Market, By Industry (USD Million/ Million m2)

6.2.6.4. Germany Key Smart Coating Market, By Surface area (Million m2)

6.2.6.5. Germany Key Smart Coating Market, By Shipment (Million m2)

6.2.7. The U.K Key Smart Coating Market (USD Million/Million m2)

6.2.7.1. The U.K Key Smart Coating Market, By Function (USD Million/ Million m2)

6.2.7.2. The U.K Key Smart Coating Market, By Type (USD Million/ Million m2)

6.2.7.3. The U.K Key Smart Coating Market, By Industry (USD Million/ Million m2)

6.2.7.4. The U.K Key Smart Coating Market, By Surface area (Million m2)

6.2.7.5. The U.K Key Smart Coating Market, By Shipment (Million m2)

6.2.8. France Key Smart Coating Market (USD Million/Million m2)

6.2.8.1. France Key Smart Coating Market, By Function (USD Million/ Million m2)

6.2.8.2. France Key Smart Coating Market, By Type (USD Million/ Million m2)

6.2.8.3. France Key Smart Coating Market, By Industry (USD Million/ Million m2)

6.2.8.4. France Key Smart Coating Market, By Surface area (Million m2)

6.2.8.5. France Key Smart Coating Market, By Shipment (Million m2)

6.2.9. Italy Key Smart Coating Market (USD Million/Million m2)

6.2.9.1. Italy Key Smart Coating Market, By Function (USD Million/ Million m2)

6.2.9.2. Italy Key Smart Coating Market, By Type (USD Million/ Million m2)

6.2.9.3. Italy Key Smart Coating Market, By Industry (USD Million/ Million m2)

6.2.9.4. Italy Key Smart Coating Market, By Surface area (Million m2)

6.2.9.5. Italy Key Smart Coating Market, By Shipment (Million m2)

6.2.10. Norway Key Smart Coating Market (USD Million/Million m2)

6.2.10.1. Norway Key Smart Coating Market, By Function (USD Million/ Million m2)

6.2.10.2. Norway Key Smart Coating Market, By Type (USD Million/ Million m2)

6.2.10.3. Norway Key Smart Coating Market, By Industry (USD Million/ Million m2)

6.2.10.4. Norway Key Smart Coating Market, By Surface area (Million m2)

6.2.10.5. Norway Key Smart Coating Market, By Shipment (Million m2)

6.2.11. Netherland Key Smart Coating Market (USD Million/Million m2)

6.2.11.1. Netherland Key Smart Coating Market, By Function (USD Million/ Million m2)

6.2.11.2. Netherland Key Smart Coating Market, By Type (USD Million/ Million m2)

6.2.11.3. Netherland Key Smart Coating Market, By Industry (USD Million/ Million m2)

6.2.11.4. Netherland Key Smart Coating Market, By Surface area (Million m2)

6.2.11.5. Netherland Key Smart Coating Market, By Shipment (Million m2)

6.3. Asia-Pacific Key Smart Coating Market (USD Million/Million m2)

6.3.1. APAC Key Smart Coating Market, By Function (USD Million/ Million m2)

6.3.2. APAC Key Smart Coating Market, By Type (USD Million/ Million m2)

6.3.3. APAC Key Smart Coating Market, By Industry (USD Million/Million m2)

6.3.4. APAC Key Smart Coating Market, By Surface area (USD Million/Million m2)

6.3.5. APAC Key Smart Coating Market, By Shipment (USD Million/ Million m2)

6.3.6. China Key Smart Coating Market (USD Million/Million m2)

6.3.6.1. China Key Smart Coating Market, By Function (USD Million/ Million m2)

6.3.6.2. China Key Smart Coating Market, By Type (USD Million/ Million m2)

6.3.6.3. China Key Smart Coating Market, By Industry (USD Million/ Million m2)

6.3.6.4. China Key Smart Coating Market, By Surface area (Million m2)

6.3.6.5. China Key Smart Coating Market, By Shipment (Million m2)

6.3.7. Japan Key Smart Coating Market (USD Million/Million m2)

6.3.7.1. Japan Key Smart Coating Market, By Function (USD Million/ Million m2)

6.3.7.2. Japan Key Smart Coating Market, By Type (USD Million/ Million m2)

6.3.7.3. Japan Key Smart Coating Market, By Industry (USD Million/ Million m2)

6.3.7.4. Japan Key Smart Coating Market, By Surface area (Million m2)

6.3.7.5. Japan Key Smart Coating Market, By Shipment (Million m2)

6.3.8. India Key Smart Coating Market (USD Million/Million m2)

6.3.8.1. India Key Smart Coating Market, By Function (USD Million/ Million m2)

6.3.8.2. India Key Smart Coating Market, By Type (USD Million/ Million m2)

6.3.8.3. India Key Smart Coating Market, By Industry (USD Million/ Million m2)

6.3.8.4. India Key Smart Coating Market, By Surface area (Million m2)

6.3.8.5. India Key Smart Coating Market, By Shipment (Million m2)

6.3.9. South Korea Key Smart Coating Market (USD Million/Million m2)

6.3.9.1. South Korea Key Smart Coating Market, By Function (USD Million/ Million m2)

6.3.9.2. South Korea Key Smart Coating Market, By Type (USD Million/ Million m2)

6.3.9.3. South Korea Key Smart Coating Market, By Industry (USD Million/ Million m2)

6.3.9.4. South Korea Key Smart Coating Market, By Surface area (Million m2)

6.3.9.5. South Korea Key Smart Coating Market, By Shipment (Million m2)

6.3.10. Singapore Key Smart Coating Market (USD Million/Million m2)

6.3.10.1. Singapore Key Smart Coating Market, By Function (USD Million/ Million m2)

6.3.10.2. Singapore Key Smart Coating Market, By Type (USD Million/ Million m2)

6.3.10.3. Singapore Key Smart Coating Market, By Industry (USD Million/ Million m2)

6.3.10.4. Singapore Key Smart Coating Market, By Surface area (Million m2)

6.3.10.5. Singapore Key Smart Coating Market, By Shipment (Million m2)

6.3.11. Australia Key Smart Coating Market (USD Million/Million m2)

6.3.11.1. Australia Key Smart Coating Market, By Function (USD Million/ Million m2)

6.3.11.2. Australia Key Smart Coating Market, By Type (USD Million/ Million m2)

6.3.11.3. Australia Key Smart Coating Market, By Industry (USD Million/ Million m2)

6.3.11.4. Australia Key Smart Coating Market, By Surface area (Million m2)

6.3.11.5. Australia Key Smart Coating Market, By Shipment (Million m2)

6.4. Central & South America (CSA) Key Smart Coating Market (USD Million/Million m2)

6.4.1. CSA Key Smart Coating Market, By Function (USD Million/ Million m2)

6.4.2. CSA Key Smart Coating Market, By Type (USD Million/ Million m2)

6.4.3. CSA Key Smart Coating Market, By Industry (USD Million/ Million m2)

6.4.4. CSA Key Smart Coating Market, By Surface area (Million m2)

6.4.5. CSA Key Smart Coating Market, By Shipment (Million m2)

6.4.6. Brazil Key Smart Coating Market (USD Million/Million m2)

6.4.6.1. Brazil Key Smart Coating Market, By Function (USD Million/ Million m2)

6.4.6.2. Brazil Key Smart Coating Market, By Type (USD Million/ Million m2)

6.4.6.3. Brazil Key Smart Coating Market, By Industry (USD Million/ Million m2)

6.4.6.4. Brazil Key Smart Coating Market, By Surface area (Million m2)

6.4.6.5. Brazil Key Smart Coating Market, By Shipment (Million m2)

6.5. Middle East & Africa (MEA) Key Smart Coating Market (USD Million/Million m2)

6.5.1. MEA Key Smart Coating Market, By Function (USD Million/ Million m2)

6.5.2. MEA Key Smart Coating Market, By Type (USD Million/ Million m2)

6.5.3. MEA Key Smart Coating Market, By Industry (USD Million/Million m2)

6.5.4. MEA Key Smart Coating Market, By Surface area (Million m2)

6.5.5. MEA Key Smart Coating Market, By Shipment (Million m2)

6.5.6. UAE Key Smart Coating Market (USD Million/Million m2)

6.5.6.1. UAE Key Smart Coating Market, By Function (USD Million/ Million m2)

6.5.6.2. UAE Key Smart Coating Market, By Type (USD Million/ Million m2)

6.5.6.3. UAE Key Smart Coating Market, By Industry (USD Million/ Million m2)

6.5.6.4. UAE Key Smart Coating Market, By Surface area (Million m2)

6.5.6.5. UAE Key Smart Coating Market, By Shipment (Million m2)

6.5.7. Saudi Arabia Key Smart Coating Market (USD Million/Million m2)

6.5.7.1. Saudi Arabia Key Smart Coating Market, By Function (USD Million/ Million m2)

6.5.7.2. Saudi Arabia Key Smart Coating Market, By Type (USD Million/ Million m2)

6.5.7.3. Saudi Arabia Key Smart Coating Market, By Industry (USD Million/ Million m2)

6.5.7.4. Saudi Arabia Key Smart Coating Market, By Surface area (Million m2)

6.5.7.5. Saudi Arabia Key Smart Coating Market, By Shipment (Million m2)

6.5.8. South Africa Key Smart Coating Market (USD Million/Million m2)

6.5.8.1. South Africa Key Smart Coating Market, By Function (USD Million/ Million m2)

6.5.8.2. South Africa Key Smart Coating Market, By Type (USD Million/ Million m2)

6.5.8.3. South Africa Key Smart Coating Market, By Industry (USD Million/ Million m2)

6.5.8.4. South Africa Key Smart Coating Market, By Surface area (Million m2)

6.5.8.5. South Africa Key Smart Coating Market, By Shipment (Million m2)

CHAPTER 7. Key Players and Strategic Developments

7.1. 3M

7.1.1. Business Overview

7.1.2. Product and Service Offering

7.1.3. Financial Overview

7.1.4. Strategic Developments

7.2. AnCatt

7.2.1. Business Overview

7.2.2. Product and Service Offering

7.2.3. Financial Overview

7.2.4. Strategic Developments

7.3. Bayer AG

7.3.1. Business Overview

7.3.2. Product and Service Offering

7.3.3. Financial Overview

7.3.4. Strategic Developments

7.4. Akzo Nobel

7.4.1. Business Overview

7.4.2. Product and Service Offering

7.4.3. Financial Overview

7.4.4. Strategic Developments

7.5. PPG Industries

7.5.1. Business Overview

7.5.2. Product and Service Offering

7.5.3. Financial Overview

7.5.4. Strategic Developments

7.6. Croda International

7.6.1. Business Overview

7.6.2. Product and Service Offering

7.6.3. Financial Overview

7.6.4. Strategic Developments

7.7. Luminary Chemical

7.7.1. Business Overview

7.7.2. Product and Service Offering

7.7.3. Overview

7.7.4. Strategic Developments

7.8. 3E Nano

7.8.1. Business Overview

7.8.2. Product and Service Offering

7.8.3. Financial Overview

7.8.4. Strategic Developments

7.9. CHOOSE NanoTech

7.9.1. Business Overview

7.9.2. Product and Service Offering

7.9.3. Financial Overview

7.9.4. Strategic Developments

7.10. C-Bond Systems

7.10.1. Business Overview

7.10.2. Product and Service Offering

7.10.3. Financial Overview

7.10.4. Strategic Developments

7.11. Segula Nano technologies

7.11.1. Business Overview

7.11.2. Product and Service Offering

7.11.3. Financial Overview

7.11.4. Strategic Developments

7.12. The Dow Chemical Company

7.12.1. Business Overview

7.12.2. Product and Service Offering

7.12.3. Financial Overview

7.12.4. Strategic Developments

7.13. Research Frontier Inc.

7.13.1. Business Overview

7.13.2. Product and Service Offering

7.13.3. Financial Overview

7.13.4. Strategic Developments

7.14. DuPont

7.14.1. Business Overview

7.14.2. Product and Service Offering

7.14.3. Financial Overview

7.14.4. Strategic Developments