Global Plastic Scoop Market Demand Outlook, COVID-19 Impact, Trend Analysis by Material (Polyphenylene Ether (PPE), polypropylene, Linear Low Density Polyethylene (LLDPE), Polyethylene Terephthalate (PET), High Impact Styrene, Metallized Plastics), by Design (Tab, Tab long handle, Double Ended, Cylindrical, Stackable), by Volume,by End-Use, and Industry Estimates 2021-2027

- Published: Nov, 2021

- Report ID: QAR-CM02036

- Format: Electronic (PDF)

- Historical Data : 2017 - 2019

- Report Summary

- Table Of Contents

- Request Sample

The Global Plastic Scoop Market is projected to grow at a CAGR of 5.8% over the next six years. Plastic scoops are ideal for food safety material handling, cleaning, and sanitation procedures that aim to eliminate cross-contamination. Rugged hand scoops are excellent for handling large materials and can be used in cross-contamination, food safety, and HACCP procedures in the workplace. Baking, meat, poultry, seafood, and milling are all popular uses for these scoops. In wet or dry food preparation, scoops are meant to reduce the possibility of cross-contamination.

The one-piece design reduces the number of places where bacteria can hide and multiply. These scoops are also chemical resistant and autoclavable. Polypropylene plastic is the most common material used to make scoops (PP). Food-safe polypropylene does not leach dangerous contaminants into foods or drinks, and as most scoops handle food or liquids, this is critical. Polypropylene plastic is also recyclable, which is a plus for the environment and environmentally conscious consumers. Polypropylene is a low-cost plastic with outstanding mechanical and moldability qualities. The new recycling trend for plastics materials is restraining the growth of plastics. Recycling available plastic/polypropylene reduces or eliminates plastic/polypropylene manufacturing.

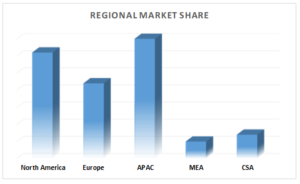

Demand for plastic scoop in developing economies of APAC Region has grown significantly over the past few years. Changing lifestyle, smart product development and growing application across various end user industries drives the demand for the plastic scoops. Polypropylene plastic holds larger share in the global market and is expected to witness significant CAGR over the forecast period.

Scope of the report

The main purpose of QuantAlign report is to provide a broad and exhaustive overview of the Global Plastic Scoop Market, and associated trends

This report fulfils the following objectives:

- Assess the market for Plastic Scoops

- Explain the market dynamics for different plastic scoop materials and End-Use

- Identify the key drivers that will shape the market’s future

- Provide an overview of the price cost analysis

- Deliver a concise overview of the different applications driving the plastic scoop business and explore niches within the industry

- Present data rankings for the industry leaders, describing and analyzing the opportunity over the forecast period, the latest developments, and future trends across the player landscape

- Provide the overview of the industry supply chain, with the main players and their market shares as well as their product portfolio

This report covers all the different plastic scoops material, and related markets. This includes

Material such as:

- Polyphenylene Ether (PPE)

- polypropylene

- Linear Low Density Polyethylene (LLDPE)

- Metallized plastics

- Polyvinyl chloride (PVC)

- Polyethylene Terephthalate (PET)

- High Impact Styrene

- Design

- End Use

This report is both application and technology oriented:

- Each important material is targeted, with specific needs and volume analyzed, in order to determine opportunity and challenges to be faced for manufacturers and their impact on the overall market

- Technology evolution and choices of the plastic scoop manufacturers in the world are analyzed, and technology evolution is provided

Special focuses are also included in this report, based on current trends both for technology and supply chain organization

- Main technological trends and ongoing development of plastic scoops

- Focus on preferred material choice

- Analyze how business models and supply chains evolve

- Current & future trends, challenges to face, especially for increasing economic competitiveness overriding environmental protection

The report provides detailed market outlook, and forecast of the “Global Plastic Scoop Market” based on, material, volume, design, end-user, and region.

Report Scope

| Research Attribute | Coverage |

|---|---|

| Years Considered | 2017-2027 |

| Historical Years | 2017, 2018, 2019 |

| Base Year | 2020 |

| Forecast Period | 2021-2027 |

| Units Considered | USD Million/Units Sold |

| Segmentation By Material |

|

| Segmentation by Volume(Liters) |

|

| Segmentation by Design |

|

| Segmentation by End-User |

|

| Regions Covered |

|

| Key Company Profiles | U.S. Plastic Corp., Measurex, Burkle Gmbh, National Measures, SwissPack, MPQ Plastics, Enrich Plastic, Fletcher, Measurex, US. Plastic Corp., Genpak LLC,HQC,Inc., Ibic Group Ltd.are among others. |

CHAPTER 1. Market Scope and Methodology

1.1. Research methodology

1.2. Objectives of the report

1.3. Research scope & assumptions

1.4. List of data sources

CHAPTER 2. Executive Summary

2.1. Plastic Scoop Market – Key industry insights

CHAPTER 3. Market Outlook

3.1. Market definition

3.2. Market segmentation

3.3. Value chain analysis

3.3.1. Raw material trends

3.3.2. Manufacturing trends

3.4. Plastic Scoop Market: developed v/s developing countries

3.5. Market opportunities & trends

3.6. Market dynamics

3.6.1. Market driver analysis

3.6.1.1. Impact analysis

3.6.2. Market restraint analysis

3.6.2.1. Impact analysis

3.7. Industry analysis – Porter’s

3.7.1. Bargaining power of suppliers

3.7.2. Bargaining power of buyers

3.7.3. Threat of new entrants

3.7.4. Threat of substitutes

3.7.5. Competitive rivalry

3.8. PESTEL analysis

3.9. SWOT Analysis

CHAPTER 4. Competitive Outlook

4.1. Competitive framework

4.2. Company market share analysis

4.3. Strategic layout

4.4. Pricing Analysis

4.5. Product Benchmarking

4.6. Opportunity Assessment

CHAPTER 5. COVID-19 Implications

5.1. Global industry impact of COVID-19 pandemic

5.1.1. Impact analysis

5.1.2. Analyst recommendations

CHAPTER 6. Global Plastic Scoop Market Size and Forecast (2017 - 2027)

6.1. Global Plastic Scoop Market, By Material (USD Million/)

6.1.1. Polyphenylene Ether (PPE)

6.1.2. polypropylene

6.1.3. Linear Low Density Polyethylene (LLDPE)

6.1.4. Metallized plastics

6.1.5. Polyvinyl chloride (PVC)

6.1.6. Polyethylene Terephthalate (PET)

6.1.7. High Impact Styrene

6.1.8. Others

6.2. Global Plastic Scoop Market, By Volume In Liters (USD Million/Units)

6.2.1. .05 - 0.15

6.2.2. 0.15-0.2

6.2.3. 0.2-0.4

6.2.4. 0.5-1.0

6.2.5. 1.0-1.5

6.2.6. 1.5-2.0

6.2.7. Others

6.3. Global Plastic Scoop Market, By Design (USD Million/Units)

6.3.1. Tab

6.3.2. Tab long handle

6.3.3. Mini

6.3.4. Double Ended

6.3.5. Cylindrical

6.3.6. Stackable

6.3.7. Others

6.4. Global Plastic Scoop Market, By End Use (USD Million/Units)

6.4.1. Household

6.4.2. Food and Beverages

6.4.3. Personal Care

6.4.4. Nutritional and Pharmaceutical Industries

6.4.5. Agriculture

6.4.6. Janitorial

6.4.7. Others

6.5. Global Plastic Scoop Market, By Region (USD Million/Units)

6.5.1. North America

6.5.2. Europe

6.5.3. Asia-Pacific

6.5.4. Central & South America (CSA)

6.5.5. Middle East & Africa (MEA)

CHAPTER 7. Global Plastic Scoop Market Size and Forecast, By Region (2017 - 2027)

7.1. North America Plastic Scoop Market (USD Million/Units)

7.1.1. North America Plastic Scoop Market, By Material (USD Million/ Units)

7.1.2. North America Plastic Scoop Market, By Volume (USD Million/ Units)

7.1.3. North America Plastic Scoop Market, By Design(USD Million/ Units)

7.1.4. North America Plastic Scoop Market, By End-Use (USD Million/ Units)

7.1.5. The U.S. Plastic Scoop Market (USD Million/ Units)

7.1.5.1. U.S. Plastic Scoop Market, By Material (USD Million/ Units)

7.1.5.2. U.S. Plastic Scoop Market, By Volume (USD Million/ Units)

7.1.5.3. U.S. Plastic Scoop Market, By Design (USD Million/ Units)

7.1.5.4. U.S. Plastic Scoop Market, By End-Use (USD Million/ Units)

7.1.6. Canada Plastic Scoop Market (USD Million/Units)

7.1.6.1. Canada Plastic Scoop Market, By Material (USD Million/ Units)

7.1.6.2. Canada Plastic Scoop Market, By Volume (USD Million/ Units)

7.1.6.3. Canada Plastic Scoop Market, By Design (USD Million/ Units)

7.1.6.4. Canada Plastic Scoop Market, By End-Use (USD Million/ Units)

7.1.7. Mexico Plastic Scoop Market (USD Million/Units)

7.1.7.1. Mexico Plastic Scoop Market, By Material (USD Million/ Units)

7.1.7.2. Mexico Plastic Scoop Market, By Volume (USD Million/ Units)

7.1.7.3. Mexico Plastic Scoop Market, By Design (USD Million/ Units)

7.1.7.4. Mexico Plastic Scoop Market, By End-Use (USD Million/ Units)

7.2. Europe Plastic Scoop Market (USD Million/Units)

7.2.1. Europe Plastic Scoop Market, By Material (USD Million/ Units)

7.2.2. Europe Plastic Scoop Market, By Volume (USD Million/ Units)

7.2.3. Europe Plastic Scoop Market, By Design (USD Million/ Units)

7.2.4. Europe Plastic Scoop Market, By End-Use (USD Million/ Units)

7.2.5. Germany Plastic Scoop Market (USD Million/Units)

7.2.5.1. Germany Plastic Scoop Market, By Material (USD Million/ Units)

7.2.5.2. Germany Plastic Scoop Market, By Volume (USD Million/ Units)

7.2.5.3. Germany Plastic Scoop Market, By Design (USD Million/ Units)

7.2.5.4. Germany Plastic Scoop Market, By End-Use (USD Million/ Units)

7.2.6. The U.K Plastic Scoop Market (USD Million/Units)

7.2.6.1. The U.K. Plastic Scoop Market, By Material (USD Million/ Units)

7.2.6.2. The U.K. Plastic Scoop Market, By Volume (USD Million/ Units)

7.2.6.3. The U.K. Plastic Scoop Market, By Design (USD Million/ Units)

7.2.6.4. The U.K. Plastic Scoop Market, By End-Use (USD Million/ Units)

7.2.7. France Plastic Scoop Market (USD Million/Units)

7.2.7.1. France Plastic Scoop Market, By Material (USD Million/ Units)

7.2.7.2. France Plastic Scoop Market, By Volume (USD Million/ Units)

7.2.7.3. France Plastic Scoop Market, By Design (USD Million/ Units)

7.2.7.4. France Plastic Scoop Market, By End-Use (USD Million/ Units)

7.2.8. Italy Plastic Scoop Market (USD Million/Units)

7.2.8.1. Italy Plastic Scoop Market, By Material (USD Million/ Units)

7.2.8.2. Italy Plastic Scoop Market, By Volume (USD Million/ Units)

7.2.8.3. Italy Plastic Scoop Market, By Design (USD Million/Units)

7.2.8.4. Italy Plastic Scoop Market, By End-Use (USD Million/ Units)

7.2.9. Spain Plastic Scoop Market (USD Million/Units)

7.2.9.1. Spain Plastic Scoop Market, By Material (USD Million/ Units)

7.2.9.2. Spain Plastic Scoop Market, By Volume (USD Million/ Units)

7.2.9.3. Spain Plastic Scoop Market, By Design (USD Million/ Units)

7.2.9.4. Spain Plastic Scoop Market, By End-Use (USD Million/ Units)

7.3. Asia-Pacific Plastic Scoop Market (USD Million/Units)

7.3.1. APAC Plastic Scoop Market, By Material (USD Million/ Units)

7.3.2. APAC Plastic Scoop Market, By Volume (USD Million/ Units)

7.3.3. APAC Plastic Scoop Market, By Design (USD Million/ Units)

7.3.4. APAC Plastic Scoop Market, By End-Use (USD Million/ Units)

7.3.5. China Plastic Scoop Market (USD Million/Units)

7.3.5.1. China Plastic Scoop Market, By Material (USD Million/ Units)

7.3.5.2. China Plastic Scoop Market, By Volume (USD Million/ Units)

7.3.5.3. China Plastic Scoop Market, By Design (USD Million/ Units)

7.3.5.4. China Plastic Scoop Market, By End-Use (USD Million/ Units)

7.3.6. Japan Plastic Scoop Market (USD Million/Units)

7.3.6.1. Japan Plastic Scoop Market, By Material (USD Million/ Units)

7.3.6.2. Japan Plastic Scoop Market, By Volume (USD Million/ Units)

7.3.6.3. Japan Plastic Scoop Market, By Design (USD Million/ Units)

7.3.6.4. Japan Plastic Scoop Market, By End-Use (USD Million/ Units)

7.3.7. India Plastic Scoop Market (USD Million/Units)

7.3.7.1. India Plastic Scoop Market, By Material (USD Million/ Units)

7.3.7.2. India Plastic Scoop Market, By Volume (USD Million/ Units)

7.3.7.3. India Plastic Scoop Market, By Design (USD Million/ Units)

7.3.7.4. India Plastic Scoop Market, By End-Use (USD Million/ Units)

7.3.8. South Korea Plastic Scoop Market (USD Million/Units)

7.3.8.1. South Korea Plastic Scoop Market, By Material (USD Million/ Units)

7.3.8.2. South Korea Plastic Scoop Market, By Volume (USD Million/ Units)

7.3.8.3. South Korea Plastic Scoop Market, By Design (USD Million/ Units)

7.3.8.4. South Korea Plastic Scoop Market, By End-Use (USD Million/ Units)

7.3.9. Malaysia Plastic Scoop Market (USD Million/Units)

7.3.9.1. Malaysia Plastic Scoop Market, By Material (USD Million/ Units)

7.3.9.2. Malaysia Plastic Scoop Market, By Volume (USD Million/ Units)

7.3.9.3. Malaysia Plastic Scoop Market, By Design (USD Million/ Units)

7.3.9.4. Malaysia Plastic Scoop Market, By End-Use (USD Million/ Units)

7.3.10. Thailand Plastic Scoop Market (USD Million/Units)

7.3.10.1. Thailand Plastic Scoop Market, By Material (USD Million/ Units)

7.3.10.2. Thailand Plastic Scoop Market, By Volume (USD Million/ Units)

7.3.10.3. Thailand Plastic Scoop Market, By Design (USD Million/ Units)

7.3.10.4. Thailand Plastic Scoop Market, By End-Use (USD Million/ Units)

7.3.11. Australia Plastic Scoop Market (USD Million/Units)

7.3.11.1. Australia Plastic Scoop Market, By Material (USD Million/ Units)

7.3.11.2. Australia Plastic Scoop Market, By Volume (USD Million/ Units)

7.3.11.3. Australia Plastic Scoop Market, By Design (USD Million/ Units)

7.3.11.4. Australia Plastic Scoop Market, By End-Use (USD Million/ Units)

7.4. Central & South America (CSA) Plastic Scoop Market (USD Million/Units)

7.4.1. CSA Plastic Scoop Market, By Material (USD Million/ Units)

7.4.2. CSA Plastic Scoop Market, By Volume (USD Million/ Units)

7.4.3. CSA Plastic Scoop Market, By Design (USD Million/ Units)

7.4.4. CSA Plastic Scoop Market, By End-Use (USD Million/ Units)

7.4.5. Brazil Plastic Scoop Market (USD Million/Units)

7.4.5.1. Australia Plastic Scoop Market, By Material (USD Million/ Units)

7.4.5.2. Brazil Plastic Scoop Market, By Volume (USD Million/ Units)

7.4.5.3. Brazil Plastic Scoop Market, By Design (USD Million/ Units)

7.4.5.4. Brazil Plastic Scoop Market, By End-Use (USD Million/ Units)

7.4.6. Argentina Plastic Scoop Market (USD Million/Units)

7.4.6.1. Argentina Plastic Scoop Market, By Material (USD Million/ Units)

7.4.6.2. Argentina Plastic Scoop Market, By Volume (USD Million/ Units)

7.4.6.3. Argentina Plastic Scoop Market, By Design (USD Million/ Units)

7.4.6.4. Argentina Plastic Scoop Market, By End-Use (USD Million/ Units)

7.5. Middle East & Africa (MEA) Plastic Scoop Market (USD Million/Units)

7.5.1. MEA Plastic Scoop Market, By Material (USD Million/ Units)

7.5.2. MEA Plastic Scoop Market, By Volume (USD Million/ Units)

7.5.3. MEA Plastic Scoop Market, By Design (USD Million/Units)

7.5.4. MEA Plastic Scoop Market, By End-Use (USD Million/ Units)

7.5.5. UAE Plastic Scoop Market (USD Million/Units)

7.5.5.1. UAE Plastic Scoop Market, By Material (USD Million/ Units)

7.5.5.2. UAE Plastic Scoop Market, By Volume (USD Million/ Units)

7.5.5.3. UAE Plastic Scoop Market, By Design (USD Million/ Units)

7.5.5.4. UAE Plastic Scoop Market, By End-Use (USD Million/ Units)

7.5.6. Saudi Arabia Plastic Scoop Market (USD Million/Units)

7.5.6.1. Saudi Arabia Plastic Scoop Market, By Material (USD Million/ Units)

7.5.6.2. Saudi Arabia Plastic Scoop Market, By Volume (USD Million/ Units)

7.5.6.3. Saudi Arabia Plastic Scoop Market, By Design (USD Million/ Units)

7.5.6.4. Saudi Arabia Plastic Scoop Market, By End-Use (USD Million/ Units)

7.5.7. South Africa Plastic Scoop Market (USD Million/Units)

7.5.7.1. South Africa Plastic Scoop Market, By Material (USD Million/ Units)

7.5.7.2. South Africa Plastic Scoop Market, By Volume (USD Million/ Units)

7.5.7.3. South Africa Plastic Scoop Market, By Design (USD Million/ Units)

7.5.7.4. South Africa Plastic Scoop Market, By End-Use (USD Million/ Units)

CHAPTER 8. Key Players and Strategic Developments

8.1. HQC, Inc.

8.1.1. Business Overview

8.1.2. Product and Service Offering

8.1.3. Financial Overview

8.1.4. Strategic Developments

8.2. Ibic Group Ltd.

8.2.1. Business Overview

8.2.2. Product and Service Offering

8.2.3. Financial Overview

8.2.4. Strategic Developments

8.3. Genpak, LLC

8.3.1. Business Overview

8.3.2. Product and Service Offering

8.3.3. Financial Overview

8.3.4. Strategic Developments

8.4. Plasticscoop.net

8.4.1. Business Overview

8.4.2. Product and Service Offering

8.4.3. Financial Overview

8.4.4. Strategic Developments

8.5. U.S. Plastic Corp

8.5.1. Business Overview

8.5.2. Product and Service Offering

8.5.3. Financial Overview

8.5.4. Strategic Developments

8.6. Measurex

8.6.1. Business Overview

8.6.2. Product and Service Offering

8.6.3. Financial Overview

8.6.4. Strategic Developments

8.7. Fletcher

8.7.1. Business Overview

8.7.2. Product and Service Offering

8.7.3. Financial Overview

8.7.4. Strategic Developments

8.8. Enrich Plastic

8.8.1. Business Overview

8.8.2. Product and Service Offering

8.8.3. Financial Overview

8.8.4. Strategic Developments

8.9. MPQ Plastics

8.9.1. Business Overview

8.9.2. Product and Service Offering

8.9.3. Financial Overview

8.9.4. Strategic Developments

8.10. SwissPack

8.10.1. Business Overview

8.10.2. Product and Service Offering

8.10.3. Financial Overview

8.10.4. Strategic Developments

8.11. National Measures

8.11.1. Business Overview

8.11.2. Product and Service Offering

8.11.3. Financial Overview

8.11.4. Strategic Developments

8.12. Burkle Gmbh

8.12.1. Business Overview

8.12.2. Product and Service Offering

8.12.3. Financial Overview

8.12.4. Strategic Developments