Global Dry Film Market Outlook, COVID-19 Impact, Trend Analysis by Thickness, Type, Application (Integrated Circuit, Printed Circuit Board, Semiconductor Imaging, Lubrication, Laser direct imaging), Industry Estimates 2021-2027

- Published: April, 2021

- Report ID: QAR-FM02029

- Format: Electronic (PDF)

- Historical Data : 2017 - 2019

- Report Summary

- Table Of Contents

- Request Sample

Surging use of dry films across various industrial applications is likely to boost market demand over the forecast period. Also, there has been a significant rise in the demand for more compact, high performance and low cost electronics among the population, which in turn is driving the market for dry films. The global value for Dry Film is forecasted to be at $1,070.32 million by 2027, expanding at a CAGR of 2.6% from 2021-2027.

Dry film may be defined as a polyester film coated with a photoresist polymer, which is sensitive to ultraviolet light. It enables the user to print circuits using any photolithography method. Dry film materials are widely used in the manufacture of printed wiring boards of PC’s, mobile devices as well as other electronic devices. However, they have major usage in the PCB industry.

Demand for more compact, high performance, and low cost electronics:

Global economic development coupled with rising internet traffic and swift propagation of mobile devices are the major factors driving the electronics sector growth. The growing trend towards personal electronic devices has led to tremendous design innovation over the past few years. Currently consumers demand small and compact, yet more powerful devices with a non-exhaustive functionality, and the trend is likely to continue over the years to come. Expanding technological advancements in consumer electronics is expected to forge new market opportunities. Moreover, rising consumer income and urbanization has positively influenced the market for dry films. Also, the growing number of Chinese players have aided in the manufacture of high performing low-cost electronics. All such factors are likely to increase market penetration for dry films in the electronics industry

Development of ultra-high resolution films:

High-end research and development being an integral part of the industry has led to major technological advancements over the past few years. One such significant advancement has been in the field of high resolution films. A novel series of ultra-high resolution laminar dry films have been developed to manufacture next generation high-density printed circuit boards.

These high-resolution dry films offer excellent circuit properties, extensive workability as well as remarkable coating tolerance, and therefore have widespread usage in printed circuit boards. This in turn expands its usage in consumer electronics, medical devices, automotive, aerospace, lighting and various other industrial applications. Moreover, increasing use of high-resolution films in advance packaging solutions has fostered market growth

Regional Insight: The Dry Film market is witnessing significant growth owing to higher demand from the APAC region, primarily from economies such as China, India, Japan and South Korea. The growing technological advancements has primarily driven the regional market over the forecast period. Furthermore, the major focus of market participants has been on innovation to develop novel products that offer high adhesion while maintaining quality standards.

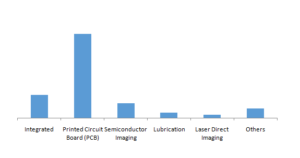

Application Insight

Report Scope

| Research Attribute | Coverage |

|---|---|

| Years Considered | 2017-2027 |

| Historical Years | 2017, 2018, 2019 |

| Base Year | 2020 |

| Forecast Period | 2021-2027 |

| Units Considered | USD Million/ Million Square Meters |

| Segmentation By Thickness |

|

| Segmentation by Application |

|

| Segmentation By Type |

|

| Regions Covered |

|

| Key Company Profiles | Mitsubishi Chemical Holdings, Hitachi Chemicals Company, Ltd., The Chemours Company, Kolon Industries, DuPont, Elga Japan, Changchun group, Vitracoat America Inc., EMS, Asahi kasei, are among others. |

CHAPTER 1. Market Scope and Methodology

1.1. Research methodology

1.2. Objectives of the report

1.3. Research scope & assumptions

1.4. List of data sources

CHAPTER 2. Executive Summary

2.1. Global Dry Film Market – Key industry insights

CHAPTER 3. Market Outlook

3.1. Market definition

3.2. Market segmentation

3.3. Value chain analysis

3.3.1. Raw material trends

3.3.2. Manufacturing trends

3.4. Technological overview

3.5. Regulatory framework

3.6. Dry Film Market: developed v/s developing countries

3.7. Market opportunities & trends

3.7.1. Increasing demand for low cost, durable and compact electronics

3.7.2. Opportunity in dry film lubrication in automotive industry

3.7.3. Development of ultra-high-resolution films

3.7.4. Industrial policy support for high tech product

3.8. Market driver analysis

3.8.1. Greater demand in Asia-Pacific economies owing to larger economies of scale

3.8.2. Usage of dry films in industrial aqueous-based products

3.8.3. Increasing application of dry films across various applications

3.8.4. Impact analysis

3.8.5. Market restraint analysis

3.8.5.1. Associated high cost

3.8.5.2. Impact analysis

3.9. Industry analysis – Porter’s

3.9.1. Bargaining power of suppliers

3.9.2. Bargaining power of buyers

3.9.3. Threat of new entrants

3.9.4. Threat of substitutes

3.9.5. Competitive rivalry

3.10. PESTEL analysis

3.11. SWOT analysis

CHAPTER 4. Competitive Outlook

4.1. Competitive framework

4.2. Company market share analysis

4.3. Strategic layout

CHAPTER 5. COVID-19 Implications

5.1. Global industry impact of COVID-19 pandemic

5.1.1. Impact analysis by end-use

5.1.2. Analyst recommendations

CHAPTER 6. Global Dry Film Market Size and Forecast (2017 - 2027)

6.1. Dry Film Market, By Thickness

6.1.1. < 25μm

6.1.2. 25-50μm

6.1.3. ≥50μm

6.2. Dry Film Market, By Type

6.2.1. Positive

6.2.2. Negative

6.3. Dry Film Market, By Application

6.3.1. Integrated Circuit

6.3.2. Printed Circuit Board (PCB)

6.3.2.1. Rigid board

6.3.2.2. Flexible board

6.3.2.3. Composite board

6.3.2.4. Others

6.3.3. Semiconductor Imaging

6.3.4. Lubrication

6.3.5. Laser direct imaging

6.3.6. Others

6.4. Dry Film Market, By Region

6.4.1. North America

6.4.2. Europe

6.4.3. Asia-Pacific

6.4.4. Central and South America (CSA)

6.4.5. Middle East and Africa (MEA)

CHAPTER 7. Global Dry Film Market Size and Forecast, By Region (2017 - 2027)

7.1. North America Dry Film Market (USD Million/Million Square Meter)

7.1.1. North America Dry Film Market, By Country

7.1.2. North America Dry Film Market, By Thickness

7.1.3. North America Dry Film Market, By Type

7.1.4. North America Dry Film Market, By Application

7.1.5. The U.S. Dry Film Market (USD Million/Million Square Meter)

7.1.5.1. The U.S. Dry Film Market, By Thickness

7.1.5.2. The U.S. Dry Film Market, By Type

7.1.5.3. The U.S. Dry Film Market, Application

7.1.6. Canada Dry Film Market (USD Million/Million Square Meter)

7.1.6.1. Canada Dry Film Market, By Thickness

7.1.6.2. Canada Dry Film Market, By Type

7.1.6.3. Canada Dry Film Market, By Application

7.1.7. Mexico Dry Film Market (USD Million/Million Square Meter)

7.1.7.1. Mexico. Dry Film Market, By Thickness

7.1.7.2. Mexico Dry Film Market, By Type

7.1.7.3. Mexico Dry Film Market, By Application

7.2. Europe Dry Film Market (USD Million/Million Square Meter)

7.2.1. Europe Dry Film Market, By Country

7.2.2. Europe Dry Film Market, By Thickness

7.2.3. Europe Dry Film Market, By Type

7.2.4. Europe Dry Film Market, By Application

7.2.5. Germany Dry Film Market (USD Million/Million Square Meter)

7.2.5.1. Germany Dry Film Market, By Thickness

7.2.5.2. Germany Dry Film Market, By Type

7.2.5.3. Germany Dry Film Market, By Application

7.2.6. U.K. Dry Film Market (USD Million/Million Square Meter)

7.2.6.1. U.K. Dry Film Market, By Thickness

7.2.6.2. U.K. Dry Film Market, By Type

7.2.6.3. U.K. Dry Film Market, By Application

7.2.7. France Dry Film Market (USD Million/Million Square Meter)

7.2.7.1. France Dry Film Market, By Thickness

7.2.7.2. France Dry Film Market, By Type

7.2.7.3. France Dry Film Market, By Application

7.2.8. Italy Dry Film Market (USD Million/Million Square Meter)

7.2.8.1. Italy Dry Film Market, By Thickness

7.2.8.2. Italy Dry Film Market, By Type

7.2.8.3. Italy Dry Film Market, By Application

7.2.9. Spain Dry Film Market (USD Million/Million Square Meter)

7.2.9.1. Spain Dry Film Market, By Thickness

7.2.9.2. Spain Dry Film Market, By Type

7.2.9.3. Spain Dry Film Market, By Application

7.3. Asia-Pacific Dry Film Market (USD Million/Million Square Meter)

7.3.1. APAC Dry Film Market, By Country

7.3.2. APAC Dry Film Market, By Thickness

7.3.3. APAC Dry Film Market, By Type

7.3.4. APAC Dry Film N Market, By Application

7.3.5. China Dry Film Market (USD Million/Million Square Meter)

7.3.5.1. China Dry Film Market, By Thickness

7.3.5.2. China Dry Film Market, By Type

7.3.5.3. China Dry Film Market, By Application

7.3.6. Japan Dry Film Market (USD Million/Million Square Meter)

7.3.6.1. Japan Dry Film Market, By Thickness

7.3.6.2. Japan Dry Film Market, By Type

7.3.6.3. Japan Dry Film Market, By Application

7.3.7. India Dry Film Market (USD Million/Million Square Meter)

7.3.7.1. India Dry Film Market, By Thickness

7.3.7.2. India Dry Film Market, By Type

7.3.7.3. India Dry Film Market, By Application

7.3.8. South Korea Dry Film Market (USD Million/Million Square Meter)

7.3.8.1. South Korea Dry Film Market, By Thickness

7.3.8.2. South Korea Dry Film Market, By Type

7.3.8.3. South Korea Dry Film Market, By Application

7.3.9. Taiwan Dry Film Market (USD Million/Million Square Meter)

7.3.9.1. Taiwan Dry Film Market, By Thickness

7.3.9.2. Taiwan Dry Film Market, By Type

7.3.9.3. Taiwan Dry Film Market, By Application

7.4. Central and South America (CSA) Dry Film Market (USD Million/Million Square Meter)

7.4.1. CSA Dry Film Market, By Country

7.4.2. CSA Dry Film Market, By Thickness

7.4.3. CSA Dry Film Market, By Type

7.4.4. CSA Dry Film Market, By Application

7.4.5. Brazil Dry Film Market (USD Million/Million Square Meter)

7.4.5.1. Brazil Dry Film Market, By Thickness

7.4.5.2. Brazil Dry Film Market, By Type

7.4.5.3. Brazil Dry Film Market, By Application

7.5. Middle East and Africa (MEA) Dry Film Market (USD Million/Million Square Meter)

7.5.1. MEA Dry Film Market, By Country

7.5.2. MEA Dry Film Market, By Thickness

7.5.3. MEA Dry Film Market, By Type

7.5.4. MEA Dry Film Market, By Application

7.5.5. UAE Dry Film Market (USD Million/Million Square Meter)

7.5.5.1. UAE Dry Film Market, By Thickness

7.5.5.2. UAE Dry Film Market, By Type

7.5.5.3. UAE Dry Film Market, By Application

7.5.6. South Africa Dry Film Market (USD Million/Million Square Meter)

7.5.6.1. South Africa Dry Film Market, By Thickness

7.5.6.2. South Africa Dry Film Market, By Type

7.5.6.3. South Africa Dry Film Market, By Application

CHAPTER 8. COMPETITIVE ANALYSIS

8.1. Porters Five Forces Analysis

8.1.1. Bargaining Power of Buyers

8.1.2. Bargaining Power of Suppliers

8.1.3. Threat of New Entrants

8.1.4. Intensity of Rivalry

8.1.5. Threat of Substitutes

CHAPTER 9. Key Players and Strategic Developments

9.1. Mitsubishi Chemical Holdings

9.1.1. Business Overview

9.1.2. Product and Service Offering

9.1.3. Financial Overview

9.1.4. Strategic Developments

9.2. Hitachi Chemicals Company, Ltd.

9.2.1. Business Overview

9.2.2. Product and Service Offering

9.2.3. Financial Overview

9.2.4. Strategic Developments

9.3. The Chemours Company

9.3.1. Business Overview

9.3.2. Product and Service Offering

9.3.3. Financial Overview

9.3.4. Strategic Developments

9.4. Kolon Industries

9.4.1. Business Overview

9.4.2. Product and Service Offering

9.4.3. Financial Overview

9.4.4. Strategic Developments

9.5. DowDuPont

9.5.1. Business Overview

9.5.2. Product and Service Offering

9.5.3. Financial Overview

9.5.4. Strategic Developments

9.6. Elga Japan.

9.6.1. Business Overview

9.6.2. Product and Service Offering

9.6.3. Financial Overview

9.6.4. Strategic Developments

9.7. Changchun group

9.7.1. Business Overview

9.7.2. Product and Service Offering

9.7.3. Financial Overview

9.7.4. Strategic Developments

9.8. Asahi Kasei

9.8.1. Business Overview

9.8.2. Product and Service Offering

9.8.3. Financial Overview

9.8.4. Strategic Developments

9.9. Vitracoat America Inc.

9.9.1. Business Overview

9.9.2. Product and Service Offering

9.9.3. Financial Overview

9.9.4. Strategic Developments

9.10. EMS

9.10.1. Business Overview

9.10.2. Product and Service Offering

9.10.3. Financial Overview

9.10.4. Strategic Developments

CHAPTER 10. Research Approach

10.1. Initial Data Search

10.2. Secondary Research

10.3. Primary Research

10.4. Scope and Assumptions