Global Drone Sensor Market Perspective, Demand Outlook, Trend Analysis, Intelligence & Industry Estimates To 2027

- Published: Dec, 2021

- Report ID: QAR-ICT02029

- Format: Electronic (PDF)

- Historical Data : 2017 - 2019

- Report Summary

- Table Of Contents

- Request Sample

Drone industry has evolved beyond its military origin towards commercial and consumer-based market. Key players of the market have realized the untapped economic potential in commercial applications, and are investing significantly to gain a foothold in this fast-evolving market. Businesses and civil governments offer a vast opportunity for growth in the coming years. Moreover, drones are now being used in construction, insurance claims, airborne inspection in pipelines, offshore oil/gas & refining, firefighting, journalism, and mining among several other applications. The global value for Drone sensor is forecasted to be valued at $2010 million by 2027, expanding at a CAGR of 18.8% from 2021-2027.

Drone industry has evolved beyond its military origin towards commercial and consumer-based market. Key players of the market have realized the untapped economic potential in commercial applications, and are investing significantly to gain a foothold in this fast-evolving market. Businesses and civil governments offer a vast opportunity for growth in the coming years. Moreover, drones are now being used in construction, insurance claims, airborne inspection in pipelines, offshore oil/gas & refining, firefighting, journalism, and mining among several other applications.

Enablers such as augmenting market of safety management software’s, and increasing demand from end-use industry have played an essential role in expediting the use of drones in commercial applications. The commercial drone market is anticipated to supersede the military drone market over the coming years. Organizations have benefitted from the applications of drones and its associated technologies, and thus to cater the demand of the future, major players such as DJI, Bosch Sensortec, TDK, and PrecisionHawk among others are investing in the drone sensor market.

Key Development:

In 2014, Parrot (France based drones manufacturer) invested USD 2 million in MicaSense to deliver drone-based sensing solutions for precision agriculture. MicaSense delivered hardware solutions for remote sensing from an unmanned aerial platform, and cloud-based analytics to provide crop health information. The company used the funding to expand its manufacturing capabilities and engineer new products. After consecutive sales growth over the years, Micasense announced 2018 to be a profitable year and its global expansion plans for coming years.

In March 2019, Spoondrift (ocean data provider) and OpenROV (manufacturer of underwater drones) announced their merger to form Sofar Ocean Technologies. The company aims to collect ocean data by developing pervasive sensors and drones transmitting information in real-time.

Intel acquired German drone company Ascending Technologies in Jan 2016. The two companies had already partnered to use Intel’s RealSense cameras to assist the drones with collision detection. Current Intel RealSense depth camera uses stereo vision to calculate depth.

The above examples exhibit an evolving drone sensor M&A environment. Over the past few years, dynamics of M&A in drone sensor market have grown expeditiously from a stagnant industry to concentric, horizontal & vertical M&A. This dynamic trend has persisted and is anticipated to continue over the forecast period

On the basis of Type, the global drone sensor market is primarily segregated into inertial sensors, image sensors, speed and distance sensors, position sensors, pressure sensors, light sensors, current sensors, and others. The image sensor holds the major share in the global drone sensor market in 2020, growing at a significant rate during the forecast period. The image sensor enables the drone to capture the image of the object by emitting the light wave, and then converting the attenuation of light waves into the signal. Image sensor segment is witnessing robust growth as it offers high resolution imagery not only in visible spectrum but also in near-infrared parts of the spectrum.

On the basis of Application, the inspection and surveillance segment is accounted to hold the major market share, in terms of revenue. The market stood at USD xx million in 2019, and is estimated to reach USD xx million by 2027, while registering a CAGR of xx% during 2020-2027. The use of UAVs for inspection tasks is increasing at a considerable rate as they help in preventing risks along with minimizing costs for capturing images and videos. Moreover, the drones facilitate in livestock management and fisheries, land tenure and land use planning, surveying, humanitarian and emergency relief, crop damage assessment, stockpile estimation, inspection of fixed and mobile assets, scientific research, media production, real estate and tourism marketing, and small cargo delivery.

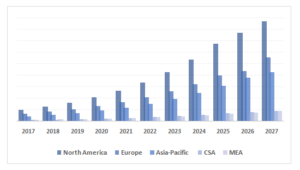

Regional Insight: North America held the major market share of xx% in 2020. Presence of major players in the region and advancement in drone technology places the region at the forefront in the global market. Asia-Pacific drone sensor market is likely to register the highest CAGR over the forecast period. With the advancement of technology in connectivity, the potential application of drones for videography has led to the major research & development activities in many end-use industries. The Europe drone sensor market was valued at USD xx million in 2020, and is expected to reach USD xx million by 2027 industry.The regional growth is attributed to the development of agile drones which can access unreachable places with high end sensors and cameras.

Report Scope

| Research Attribute | Coverage |

|---|---|

| Years Considered | 2017-2027 |

| Historical Years | 2017, 2018, 2019 |

| Base Year | 2020 |

| Forecast Period | 2021-2027 |

| Units Considered | USD Million |

| Segmentation By Type |

|

| Segmentation by Platform |

|

| Segmentation by Application |

|

| Segmentation by End-Use |

|

| Region Covered |

|

| Key Company Profiles | Trimble Inc., Bosch Sensortec GmbH, TDK, SpartonNavEx, Raytheon, LORD Corporation, Systron Donner Inertia, Velodyne LiDAR, ams AG, LeddarTechInc, Infineon Technologies AG, PrecisionHawk, Sentera, Inc. are among others. |

CHAPTER 1. Market Scope and Methodology

1.1. Research methodology

1.2. Objectives of the report

1.3. Research scope & assumptions

1.4. List of data sources

CHAPTER 2. Executive Summary

2.1. Fiber Optic Sensor Market – Key industry insights

CHAPTER 3. Market Outlook

3.1. Market definition

3.2. Market segmentation

3.3. Value chain analysis

3.3.1. Raw material trends

3.3.2. Manufacturing trends

3.4. Technological overview

3.5. Fiber Optic Sensor Market: developed v/s developing countries

3.6. Market opportunities & trends

3.7. Market dynamics

3.7.1. Market driver analysis

3.7.1.1. Impact analysis

3.7.2. Market restraint analysis

3.7.2.1. Impact analysis

3.8. Industry analysis – Porter’s

3.8.1. Bargaining power of suppliers

3.8.2. Bargaining power of buyers

3.8.3. Threat of new entrants

3.8.4. Threat of substitutes

3.8.5. Competitive rivalry

3.9. PESTEL analysis

3.10. SWOT Analysis

3.11. Pricing Analysis

CHAPTER 4. Competitive Outlook

4.1. Competitive framework

4.2. Company market share analysis

4.3. Strategic layout

4.4. Opportunity Assessment

CHAPTER 5. COVID-19 Implications

5.1. Global industry impact of COVID-19 pandemic

5.1.1. Impact analysis

5.1.2. Analyst recommendations

CHAPTER 6. Global Fiber Optic Sensor Market Size and Forecast (2017 - 2027)

6.1. Global Fiber Optic Sensor Market, By Type (USD Billion)

6.1.1. Intrinsic Fiber Optic Sensors

6.1.2. Extrinsic Fiber Optic Sensors

6.2. Global Fiber Optic Sensor Market, By Component (USD Billion)

6.2.1. Transmitters

6.2.2. Receivers

6.2.3. Optical Amplifiers

6.2.4. Others

6.3. Global Fiber Optic Sensor Market, By End-Use (USD Billion)

6.3.1. Defense

6.3.2. Oil & Gas

6.3.3. Healthcare

6.3.4. Energy & Utilities

6.3.5. Telecommunication

6.3.6. Automotive and Transportation

6.3.7. Industrial Manufacturing

6.3.8. Others

6.4. Global Fiber Optic Sensor Market, By Region (USD Billion)

6.4.1. North America

6.4.2. Europe

6.4.3. Asia-Pacific

6.4.4. Central & South America (CSA)

6.4.5. Middle East & Africa (MEA)

CHAPTER 7. Global Fiber Optic Sensor Market Size and Forecast, By Region (2017 - 2027)

7.1. North America Fiber Optic Sensor Market (USD Billion)

7.1.1. North America Fiber Optic Sensor Market, By Country (USD Billion)

7.1.2. North America Fiber Optic Sensor Market, By Product Type (USD Billion)

7.1.3. North America Fiber Optic Sensor Market, By Application (USD Billion)

7.1.4. The U.S. Fiber Optic Sensor Market (USD Billion)

7.1.4.1. U.S. Fiber Optic Sensor Market, By Product Type (USD Billion)

7.1.4.2. U.S. Fiber Optic Sensor Market, By Application (USD Billion)

7.1.5. Canada Fiber Optic Sensor Market (USD Billion)

7.1.5.1. Canada Fiber Optic Sensor Market, By Product Type (USD Billion)

7.1.5.2. Canada Fiber Optic Sensor Market, By Application (USD Billion)

7.1.6. Mexico Fiber Optic Sensor Market (USD Billion)

7.1.6.1. Mexico Fiber Optic Sensor Market, By Product Type (USD Billion)

7.1.6.2. Mexico Fiber Optic Sensor Market, By Application (USD Billion)

7.2. Europe Fiber Optic Sensor Market (USD Billion)

7.2.1. Europe Fiber Optic Sensor Market, By Country (USD Billion)

7.2.2. Europe Fiber Optic Sensor Market, By Product Type (USD Billion)

7.2.3. Europe Fiber Optic Sensor Market, By Application (USD Billion)

7.2.4. Germany Fiber Optic Sensor Market (USD Billion)

7.2.4.1. Germany Fiber Optic Sensor Market, By Product Type (USD Billion)

7.2.4.2. Germany Fiber Optic Sensor Market, By Application (USD Billion)

7.2.5. The U.K Fiber Optic Sensor Market (USD Billion)

7.2.5.1. The U.K. Fiber Optic Sensor Market, By Product Type (USD Billion)

7.2.5.2. The U.K. Fiber Optic Sensor Market, By Application (USD Billion)

7.2.6. France Fiber Optic Sensor Market (USD Billion)

7.2.6.1. France Fiber Optic Sensor Market, By Product Type (USD Billion)

7.2.6.2. France Fiber Optic Sensor Market, By Application (USD Billion)

7.2.7. Italy Fiber Optic Sensor Market (USD Billion)

7.2.7.1. Italy Fiber Optic Sensor Market, By Product Type (USD Billion)

7.2.7.2. Italy Fiber Optic Sensor Market, By Application (USD Billion)

7.3. Asia-Pacific Fiber Optic Sensor Market (USD Billion)

7.3.1. APAC Fiber Optic Sensor Market, By Country (USD Billion)

7.3.2. APAC Fiber Optic Sensor Market, By Product Type (USD Billion)

7.3.3. APAC Fiber Optic Sensor Market, By Application (USD Billion)

7.3.4. China Fiber Optic Sensor Market (USD Billion)

7.3.4.1. China Fiber Optic Sensor Market, By Product Type (USD Billion)

7.3.4.2. China Fiber Optic Sensor Market, By Application (USD Billion)

7.3.5. Japan Fiber Optic Sensor Market (USD Billion)

7.3.5.1. Japan Fiber Optic Sensor Market, By Product Type (USD Billion)

7.3.5.2. Japan Fiber Optic Sensor Market, By Application (USD Billion)

7.3.6. India Fiber Optic Sensor Market (USD Billion)

7.3.6.1. India Fiber Optic Sensor Market, By Product Type (USD Billion)

7.3.6.2. India Fiber Optic Sensor Market, By Application (USD Billion)

7.3.7. Australia Fiber Optic Sensor Market (USD Billion)

7.3.7.1. Australia Fiber Optic Sensor Market, By Product Type (USD Billion)

7.3.7.2. Australia Fiber Optic Sensor Market, By Application (USD Billion)

7.4. Central & South America (CSA) Fiber Optic Sensor Market (USD Billion)

7.4.1. CSA Fiber Optic Sensor Market, By Country (USD Billion)

7.4.2. CSA Fiber Optic Sensor Market, By Product Type (USD Billion)

7.4.3. CSA Fiber Optic Sensor Market, By Application (USD Billion)

7.4.4. Brazil Fiber Optic Sensor Market (USD Billion)

7.4.4.1. Brazil Fiber Optic Sensor Market, By Product Type (USD Billion)

7.4.4.2. Brazil Fiber Optic Sensor Market, By Application (USD Billion)

7.5. Middle East & Africa (MEA) Fiber Optic Sensor Market (USD Billion)

7.5.1. MEA Fiber Optic Sensor Market, By Country (USD Billion)

7.5.2. MEA Fiber Optic Sensor Market, By Product Type (USD Billion)

7.5.3. MEA Fiber Optic Sensor Market, By Application (USD Billion)

7.5.4. South Africa Fiber Optic Sensor Market (USD Billion)

7.5.4.1. South Africa Fiber Optic Sensor Market, By Product Type (USD Billion)

7.5.4.2. South Africa Fiber Optic Sensor Market, By Application (USD Billion)

CHAPTER 8. Key Players and Strategic Developments

8.1. Omron

8.1.1. Business Overview

8.1.2. Product and Service Offering

8.1.3. Financial Overview

8.1.4. Strategic Developments

8.2. 7.2. FBGS Technologies GmbH

8.2.1. Business Overview

8.2.2. Product and Service Offering

8.2.3. Financial Overview

8.2.4. Strategic Developments

8.3. Proximion

8.3.1. Business Overview

8.3.2. Product and Service Offering

8.3.3. Financial Overview

8.3.4. Strategic Developments

8.4. Smart Fibers Ltd.

8.4.1. Business Overview

8.4.2. Product and Service Offering

8.4.3. Financial Overview

8.4.4. Strategic Developments

8.5. Sensornet

8.5.1. Business Overview

8.5.2. Product and Service Offering

8.5.3. Financial Overview

8.5.4. Strategic Developments

8.6. IFOS

8.6.1. Business Overview

8.6.2. Product and Service Offering

8.6.3. Financial Overview

8.6.4. Strategic Developments

8.7. Redondo Optics

8.7.1. Business Overview

8.7.2. Product and Service Offering

8.7.3. Financial Overview

8.7.4. Strategic Developments

8.8. Northrop Grumman Corporation

8.8.1. Business Overview

8.8.2. Product and Service Offering

8.8.3. Financial Overview

8.8.4. Strategic Developments

8.9. Bandweaver

8.9.1. Business Overview

8.9.2. Product and Service Offering

8.9.3. Financial Overview

8.9.4. Strategic Developments

8.10. TE Connectivity Ltd.

8.10.1. Business Overview

8.10.2. Product and Service Offering

8.10.3. Financial Overview

8.10.4. Strategic Developments

8.11. SensoPart Industriesensorik GmbH

8.11.1. Business Overview

8.11.2. Product and Service Offering

8.11.3. Financial Overview

8.11.4. Strategic Developments

8.12. Baumer

8.12.1. Business Overview

8.12.2. Product and Service Offering

8.12.3. Financial Overview

8.12.4. Strategic Developments

8.13. Micron Optics

8.13.1. Business Overview

8.13.2. Product and Service Offering

8.13.3. Financial Overview

8.13.4. Strategic Developments

8.14. Leviton Manufacturing Co.

8.14.1. Business Overview

8.14.2. Product and Service Offering

8.14.3. Financial Overview

8.14.4. Strategic Developments