Global GI Endoscopic Guidewire Market Demand Outlook, COVID-19 Impact, Trend Analysis by Material (Stainless Steel, Nitinol, Hybrid), by Indications (ERCP, Upper-GI Endoscopic, Endoscopic Ultrasound (EUS), Colonoscopy), by End Use, and Industry Estimates 2021-2027

- Published: Jan, 2021

- Report ID: QAR-HB02023

- Format: Electronic (PDF)

- Historical Data : 2017 - 2019

- Report Summary

- Table Of Contents

- Request Sample

The global GI endoscopic guidewire market is likely to be valued at USD 584 million by 2027, at a CAGR of 7.3% from 2021–2027. Rising adoption of minimally invasive therapies and favorable medical reimbursement policies is expected to promote the market demand. Also, growing research and development activities along with rising healthcare expenditure across emerging economies is likely to drive the market for GI endoscopic guidewire over the forecast period.

Additionally, growing research and development activities are likely to fuel the demand for endoscopic guidewires over the coming years. Advancements in healthcare equipment in the recent years have propelled the market for guidewires at a global scale. The improvement in precision mechanics, electronic circuits, and embedded software has enhanced the efficacy of guidewires. Key players of the market have increased their investments in research and development of guidewires, which has in turn led to development of newer technologies.

Moreover, endoscopic surgeries are witnessing strong gains as endoscopic imaging has become primary technique for detection and treatment of chronic and acute diseases owing to its unique capability of targeting hard-to-reach areas. Minimally invasive procedures have evolved into highly accurate, sensitive, and less invasive surgical procedures. Over the years, these procedures have been employed across diverse medical specialties such as cardiothoracic, orthopaedic, urological, vascular, and neurological procedures. The report provides detailed market outlook, and forecast the “Global GI Endoscopic Guidewire” market based on material, indications, end-use and region.

Segment overview

On the basis of material, the Nitinol segment held the largest share of the global market in 2020. Nitinol, also known as nickel-titanium alloy, contains nearly an equal amount of nickel and titanium. It has major applications in medical devices where its unique properties allow minimally invasive surgery and implants to improve quality of life for people. Moreover, its major properties such as nonmagnetic, corrosion resistance, biocompatible, and heat resistance, have further augmented market growth.

On the basis of end-use, the hospital segment accounted for the largest share of the global market in 2020, and the trend is expected to continue over the coming years. A rise in the demand for medical devices from hospitals is likely to drive the demand for guidewires in a hospital setting. However, ambulatory surgical centers are increasingly coming up in addition to hospitals. ASCs aim at providing modern health care facilities that focus on surgical treatments, including diagnostic and preventive procedures, on the same day.

On the basis of region, North America dominated the global market for GI endoscopic guidewire in 2020 on account of technological innovations that have led to product enhancements such as tip design, retention and flexibility, resulting in the constant development of technically advanced products. Moreover, the presence of well-defined regulatory framework, better healthcare infrastructure, and experienced healthcare professionals to perform the procedures are some of the key factors leading to growth of the market.

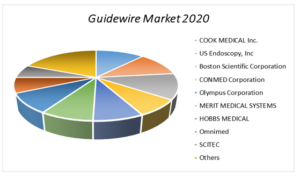

Key players operating in the market include COOK MEDICAL Inc.; US Endoscopic, Inc.; Boston Scientific Corporation; CONMED Corporation; Olympus Corporation; MERIT MEDICAL SYSTEMS, INC.; HOBBS MEDICAL INC.; Medico’s-Hirata Inc.; Omnimed Ltd, SCITEC and Zhejiang Chuangxiang Medical Technology Co., Ltd.; among others.

Report Scope

| Research Attribute | Coverage |

|---|---|

| Years Considered | 2017-2027 |

| Historical Years | 2017, 2018, 2019 |

| Base Year | 2020 |

| Forecast Period | 2021-2027 |

| Units Considered | USD Million |

| Segmentation By Material |

|

| Segmentation by Indication |

|

| Segmentation By End-Use |

|

| Regions Covered |

|

| Key Company Profiles | COOK MEDICAL Inc., US Endoscopy, Inc., Boston Scientific Corporation, CONMED Corporation, Olympus Corporation, MERIT MEDICAL SYSTEMS, INC., HOBBS MEDICAL INC., Medico’s-Hirata Inc., Omnimed Ltd, SCITEC, Taewoong Medical Co., Ltd & Zhejiang Chuangxiang Medical Technology Co., Ltd., among others. |

CHAPTER 1. Market Scope and Methodology

1.1. Research methodology

1.2. Objectives of the report

1.3. Research scope & assumptions

1.4. List of data sources

CHAPTER 2. Executive Summary

2.1. GI endoscopic guidewire market – Key industry insights

CHAPTER 3. Market Outlook

3.1. Market definition

3.2. Market segmentation

3.3. Value chain analysis

3.4. Technological overview

3.5. GI endoscopic guidewire market : developed v/s developing countries

3.6. Market opportunities & trends

3.6.1. Rising geriatric population across the globe

3.6.2. Rising healthcare expenditure across emerging economies

3.7. Market dynamics

3.7.1. Market driver analysis

3.7.1.1. Growing research and development activities and product innovation

3.7.1.2. Favorable medical reimbursement policies

3.7.1.3. Increasing preference for minimal invasive surgeries

3.7.1.4. Impact analysis

3.7.2. Market restraint analysis

3.7.2.1. Lack of trained professionals

3.7.2.2. Impact analysis

3.8. Industry analysis – Porter’s

3.8.1. Bargaining power of suppliers

3.8.2. Bargaining power of buyers

3.8.3. Threat of new entrants

3.8.4. Threat of substitutes

3.8.5. Competitive rivalry

3.9. PESTEL analysis

CHAPTER 4. Competitive Outlook

4.1. Competitive framework

4.2. Company market share analysis

4.3. Strategic layout

CHAPTER 5. COVID-19 Implications

5.1. Global industry impact of COVID-19 pandemic

5.1.1. Impact analysis by end-use

5.1.2. Analyst recommendations

CHAPTER 6. Global GI Endoscopic Guidewire Market Size and Forecast (2017 - 2027)

6.1. Global GI Endoscopic Guidewire Market, By Material (USD Million)

6.1.1. Stainless Steel

6.1.2. Nitinol

6.1.3. Hybrid

6.2. Global GI Endoscopic Guidewire Market, By Indications (USD Million)

6.2.1. ERCP

6.2.2. Upper-GI endoscopic

6.2.3. Endoscopic Ultrasound (EUS)

6.2.4. Colonoscopy

6.3. Global GI Endoscopic Guidewire Market, By End-Use (USD Million)

6.3.1. Hospitals

6.3.2. Ambulatory Surgical Centers

6.3.3. Diagnostic Centers & Surgical Centers

6.3.4. Research Laboratories & Academic Institutes

6.4. Global GI Endoscopic Guidewire Market, By Region (USD Million)

6.4.1. North America

6.4.2. Europe

6.4.3. Asia-Pacific

6.4.4. Central & South America (CSA)

6.4.5. Middle East & Africa (MEA)

CHAPTER 7. Global GI Endoscopic Guidewire Market Size and Forecast, By Region (2017 - 2027)

7.1. North America GI Endoscopic Guidewire Market (USD Million)

7.1.1. North America GI Endoscopic Guidewire Market, By Country (USD Million)

7.1.2. North America GI Endoscopic Guidewire Market, By Material (USD Million)

7.1.3. North America GI Endoscopic Guidewire Market, By Indications (USD Million)

7.1.4. North America GI Endoscopic Guidewire Market, By End-Use (USD Million)

7.1.5. The U.S. GI Endoscopic Guidewire Market (USD Million)

7.1.5.1. The U.S. GI Endoscopic Guidewire Market, By Material (USD Million)

7.1.5.2. The U.S. GI Endoscopic Guidewire Market, By Indications (USD Million)

7.1.5.3. The U.S. GI Endoscopic Guidewire Market, By End-Use (USD Million)

7.1.6. Canada GI Endoscopic Guidewire Market (USD Million)

7.1.6.1. Canada GI Endoscopic Guidewire Market, By Material (USD Million)

7.1.6.2. Canada GI Endoscopic Guidewire Market, By Indications (USD Million)

7.1.6.3. Canada GI Endoscopic Guidewire Market, By End-Use (USD Million)

7.1.7. Mexico GI Endoscopic Guidewire Market (USD Million)

7.1.7.1. Mexico GI Endoscopic Guidewire Market, By Material (USD Million)

7.1.7.2. Mexico GI Endoscopic Guidewire Market, By Indications (USD Million)

7.1.7.3. Mexico GI Endoscopic Guidewire Market, By End-Use (USD Million)

7.2. Europe GI Endoscopic Guidewire Market (USD Million)

7.2.1. Europe GI Endoscopic Guidewire Market, By Country (USD Million)

7.2.2. Europe GI Endoscopic Guidewire Market, By Material (USD Million)

7.2.3. Europe GI Endoscopic Guidewire Market, By Indications (USD Million)

7.2.4. Europe GI Endoscopic Guidewire Market, By End-Use (USD Million)

7.2.5. Germany GI Endoscopic Guidewire Market (USD Million)

7.2.5.1. Germany GI Endoscopic Guidewire Market, By Material (USD Million)

7.2.5.2. Germany GI Endoscopic Guidewire Market, By Indications (USD Million)

7.2.5.3. Germany GI Endoscopic Guidewire Market, By End-Use (USD Million)

7.2.6. The U.K GI Endoscopic Guidewire Market (USD Million)

7.2.6.1. The U.K GI Endoscopic Guidewire Market, By Material (USD Million)

7.2.6.2. The U.K GI Endoscopic Guidewire Market, By Indications (USD Million)

7.2.6.3. The U.K GI Endoscopic Guidewire Market, By End-Use (USD Million)

7.2.7. France GI Endoscopic Guidewire Market (USD Million)

7.2.7.1. France GI Endoscopic Guidewire Market, By Material (USD Million)

7.2.7.2. France GI Endoscopic Guidewire Market, By Indications (USD Million)

7.2.7.3. France GI Endoscopic Guidewire Market, By End-Use (USD Million)

7.2.8. Russia GI Endoscopic Guidewire Market (USD Million)

7.2.8.1. Russia GI Endoscopic Guidewire Market, By Material (USD Million)

7.2.8.2. Russia GI Endoscopic Guidewire Market, By Indications (USD Million)

7.2.8.3. Russia GI Endoscopic Guidewire Market, By End-Use (USD Million)

7.2.9. Italy GI Endoscopic Guidewire Market (USD Million)

7.2.9.1. Italy GI Endoscopic Guidewire Market, By Material (USD Million)

7.2.9.2. Italy GI Endoscopic Guidewire Market, By Indications (USD Million)

7.2.9.3. Italy GI Endoscopic Guidewire Market, By End-Use (USD Million)

7.2.10. Spain GI Endoscopic Guidewire Market (USD Million)

7.2.10.1. Spain GI Endoscopic Guidewire Market, By Material (USD Million)

7.2.10.2. Spain GI Endoscopic Guidewire Market, By Indications (USD Million)

7.2.10.3. Spain GI Endoscopic Guidewire Market, By End-Use (USD Million)

7.3. Asia-Pacific GI Endoscopic Guidewire Market (USD Million)

7.3.1. Asia-Pacific GI Endoscopic Guidewire Market, By Country (USD Million)

7.3.2. Asia-Pacific GI Endoscopic Guidewire Market, By Material (USD Million)

7.3.3. Asia-Pacific GI Endoscopic Guidewire Market, By Indications (USD Million)

7.3.4. Asia-Pacific GI Endoscopic Guidewire Market, By End-Use (USD Million)

7.3.5. China GI Endoscopic Guidewire Market (USD Million)

7.3.5.1. China GI Endoscopic Guidewire Market, By Material (USD Million)

7.3.5.2. China GI Endoscopic Guidewire Market, By Indications (USD Million)

7.3.5.3. China GI Endoscopic Guidewire Market, By End-Use (USD Million)

7.3.6. Japan GI Endoscopic Guidewire Market (USD Million)

7.3.6.1. Japan GI Endoscopic Guidewire Market, By Material (USD Million)

7.3.6.2. Japan GI Endoscopic Guidewire Market, By Indications (USD Million)

7.3.6.3. Japan GI Endoscopic Guidewire Market, By End-Use (USD Million)

7.3.7. India GI Endoscopic Guidewire Market (USD Million)

7.3.7.1. India GI Endoscopic Guidewire Market, By Material (USD Million)

7.3.7.2. India GI Endoscopic Guidewire Market, By Indications (USD Million)

7.3.7.3. India GI Endoscopic Guidewire Market, By End-Use (USD Million)

7.3.8. Australia GI Endoscopic Guidewire Market (USD Million)

7.3.8.1. Australia GI Endoscopic Guidewire Market, By Material (USD Million)

7.3.8.2. Australia GI Endoscopic Guidewire Market, By Indications (USD Million)

7.3.8.3. Australia GI Endoscopic Guidewire Market, By End-Use (USD Million)

7.4. Central & South America (CSA) GI Endoscopic Guidewire Market (USD Million)

7.4.1. Central & South America (CSA) GI Endoscopic Guidewire Market, By Country (USD Million)

7.4.2. Central & South America (CSA) GI Endoscopic Guidewire Market, By Material (USD Million)

7.4.3. Central & South America (CSA) GI Endoscopic Guidewire Market, By Indications (USD Million)

7.4.4. Central & South America (CSA) GI Endoscopic Guidewire Market, By End-Use (USD Million)

7.4.5. Brazil GI Endoscopic Guidewire Market (USD Million)

7.4.5.1. Brazil GI Endoscopic Guidewire Market, By Material (USD Million)

7.4.5.2. Brazil GI Endoscopic Guidewire Market, By Indications (USD Million)

7.4.5.3. Brazil GI Endoscopic Guidewire Market, By End-Use (USD Million)

7.5. Middle East & Africa (MEA) GI Endoscopic Guidewire Market (USD Million)

7.5.1. Middle East & Africa (MEA) GI Endoscopic Guidewire Market, By Country (USD Million)

7.5.2. Middle East & Africa (MEA) GI Endoscopic Guidewire Market, By Material (USD Million)

7.5.3. Middle East & Africa (MEA) GI Endoscopic Guidewire Market, By Indications (USD Million)

7.5.4. Middle East & Africa (MEA) GI Endoscopic Guidewire Market, By End-Use (USD Million)

7.5.5. Saudi Arabia GI Endoscopic Guidewire Market (USD Million)

7.5.5.1. Saudi Arabia GI Endoscopic Guidewire Market, By Material (USD Million)

7.5.5.2. Saudi Arabia GI Endoscopic Guidewire Market, By Indications (USD Million)

7.5.5.3. Saudi Arabia GI Endoscopic Guidewire Market, By End-Use (USD Million)

7.5.6. South Africa GI Endoscopic Guidewire Market (USD Million)

7.5.6.1. South Africa GI Endoscopic Guidewire Market, By Material (USD Million)

7.5.6.2. South Africa GI Endoscopic Guidewire Market, By Indications (USD Million)

7.5.6.3. South Africa GI Endoscopic Guidewire Market, By End-Use (USD Million)

CHAPTER 8. Key Players and Strategic Developments

8.1. COOK MEDICAL Inc.

8.1.1. Business Overview

8.1.2. Product and Service Offering

8.1.3. Financial Overview

8.1.4. Strategic Developments

8.2. US Endoscopic, Inc.

8.2.1. Business Overview

8.2.2. Product and Service Offering

8.2.3. Financial Overview

8.2.4. Strategic Developments

8.3. Boston Scientific Corporation

8.3.1. Business Overview

8.3.2. Product and Service Offering

8.3.3. Financial Overview

8.3.4. Strategic Developments

8.4. CONMED Corporation

8.4.1. Business Overview

8.4.2. Product and Service Offering

8.4.3. Financial Overview

8.4.4. Strategic Developments

8.5. Olympus Corporation

8.5.1. Business Overview

8.5.2. Product and Service Offering

8.5.3. Financial Overview

8.5.4. Strategic Developments

8.6. MERIT MEDICAL SYSTEMS, INC.

8.6.1. Business Overview

8.6.2. Product and Service Offering

8.6.3. Financial Overview

8.6.4. Strategic Developments

8.7. HOBBS MEDICAL INC.

8.7.1. Business Overview

8.7.2. Product and Service Offering

8.7.3. Financial Overview

8.7.4. Strategic Developments

8.8. Medico’s-Hirata Inc.

8.8.1. Business Overview

8.8.2. Product and Service Offering

8.8.3. Financial Overview

8.8.4. Strategic Developments

8.9. Omnimed Ltd

8.9.1. Business Overview

8.9.2. Product and Service Offering

8.9.3. Financial Overview

8.9.4. Strategic Developments

8.10. Zhejiang Chuangxiang Medical Technology Co., Ltd.

8.10.1. Business Overview

8.10.2. Product and Service Offering

8.10.3. Financial Overview

8.10.4. Strategic Developments

8.11. Hunan Reborn Medical Science and Technology Development Co., Ltd.

8.11.1. Business Overview

8.11.2. Product and Service Offering

8.11.3. Financial Overview

8.11.4. Strategic Developments

8.12. Sumitomo Bakelite Co., Ltd.

8.12.1. Business Overview

8.12.2. Product and Service Offering

8.12.3. Financial Overview

8.12.4. Strategic Developments

8.13. PLS Minimally Invasive Interventional Medical Co., LTD

8.13.1. Business Overview

8.13.2. Product and Service Offering

8.13.3. Financial Overview

8.13.4. Strategic Developments

8.14. SCITEC

8.14.1. Business Overview

8.14.2. Product and Service Offering

8.14.3. Financial Overview

8.14.4. Strategic Developments

8.15. Diagmed Healthcare

8.15.1. Business Overview

8.15.2. Product and Service Offering

8.15.3. Financial Overview

8.15.4. Strategic Developments

8.16. Taewoong Medical Co., Ltd

8.16.1. Business Overview

8.16.2. Product and Service Offering

8.16.3. Financial Overview

8.16.4. Strategic Developments

8.17. SSEM Mthembu Medical (Pty) Ltd.

8.17.1. Business Overview

8.17.2. Product and Service Offering

8.17.3. Financial Overview

8.17.4. Strategic Developments

8.18. Explore Synergy Inc.

8.18.1. Business Overview

8.18.2. Product and Service Offering

8.18.3. Financial Overview

8.18.4. Strategic Developments